Credit Builder Loans: Here to Improve Your Score

Everyone knows how important a credit score is. Although it’s only three digits, it holds a lot of power, especially if your score is low. Creditors use it to assess how likely you are to repay your loans, and a high score helps you qualify for low interest rates while also giving you the ability to borrow more money for purchases.

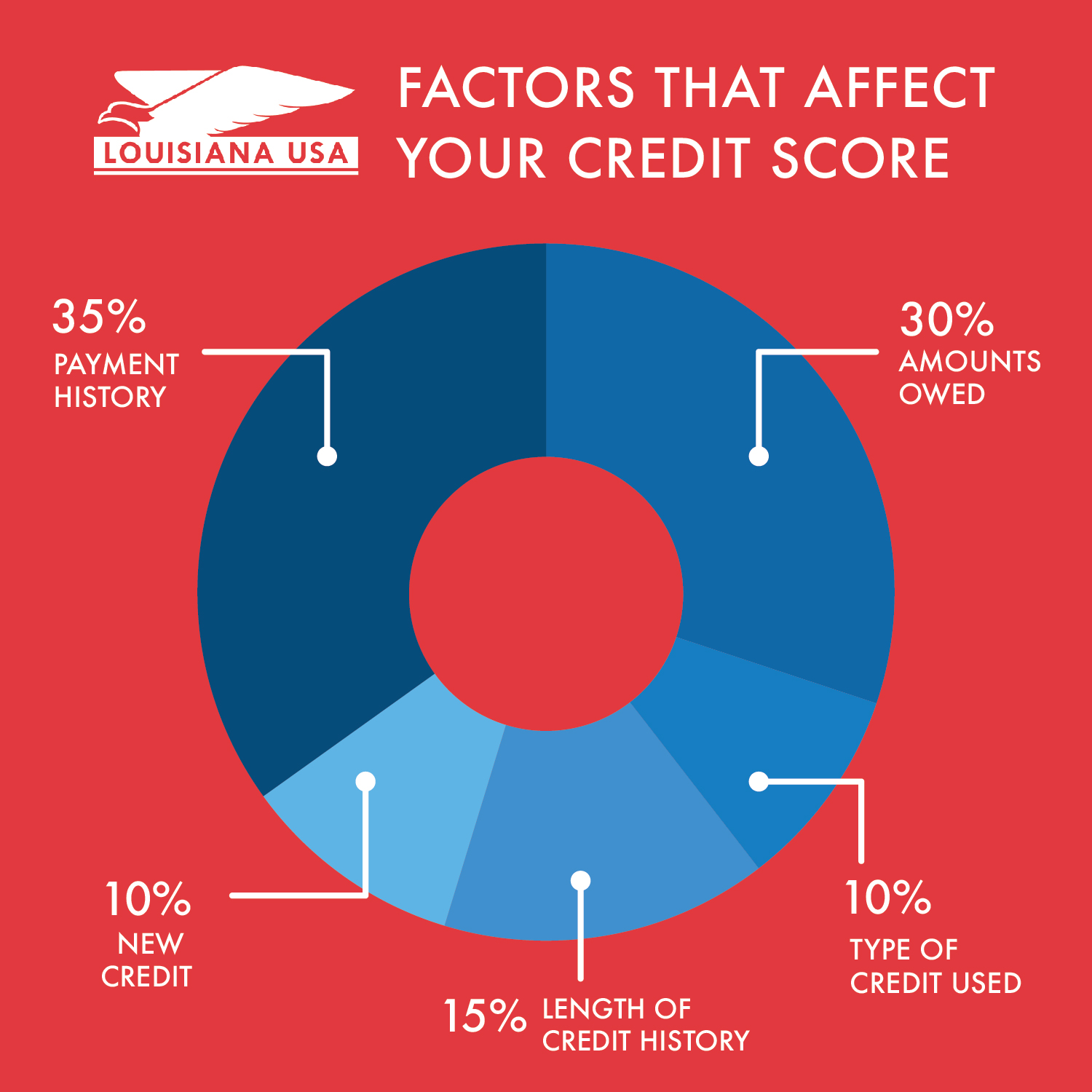

Your score is determined by five main factors: payment history (35%), accounts owed (30%), length of credit history (15%), new credit (10%) and types of credit in use (10%). But, building and maintaining a healthy score can feel unattainable or overly difficult for younger people and those with previous financial trouble.

At Louisiana USA, we have loan options specifically designed to help with these problems. Credit builder loans, also known as short-term solution loans, are perfect for building or rebuilding credit. These loans were granted by the NCUA to prevent members from going to predatory payday lenders and serve as a great helping hand.

So, how do credit builder loans work?

We initially loan members a small amount for six months to a year – this will help to establish installment credit. We recommend keeping the loan open for the full amount of time so the length of the credit history is longer. After this, we’ll issue a credit card with a small limit to help improve revolving credit.

After six to eight months, members should be getting a balanced credit report and score. From then, we can increase limits or loan amounts as needed.